One of the largest problems in trading any kind of financial instrument is how to analyze price action. Present 10 different traders with a given candle chart and ask them to classify market trend, support and resistance and chart patterns and the chances are you will receive 10 different looking sets of analysis in return. Not only is it likely that traders will differ substantially in the important areas identified, present the same trader with the same chart, at a different time, it is highly likely that the two charts you will now have will be different to each other.

The majority of traders who do not have an objective technique for analyzing price action will suffer from this inconsistency in their identification of market trend, support and resistance and chart patterns as their analysis is purely subjective – based upon human judgments and as we all know, humans do make mistakes and the decisions we make are often affected by the circumstances we find ourselves in. For example, place a human under pressure and we are more likely to make those mistakes. Being in danger of losing your own money in the financial markets, is one of the highest pressure situations you can find yourself in.

Consequently, as a trader, being able to make consistent and correct decisions in this environment is very important. Not only is your own money at stake, but the environment in which you find yourself each day encourages to make mistakes in managing that money. It is for this reason at Swing Trends, we aim to remove as much of the subjective decision-making as possible from trading. This removes pressure from a trader, lessens the chance incorrect decisions being made and helps keep emotions in check. All of which can increase ones profitability.

By using W.D. Gann’s 3 period swing charts as an objective guide to market trend, support and resistance and chart pattern formations we achieve this.

What are “Gann 3 period swing charts”?

Simply, a Gann “swing chart” is an objective way of assessing market price action and judging where market “highs” and “lows” have occurred. These highs and lows can then be used to judge trend, the location of support and resistance and to define chart patterns. It is termed a “Gann” swing chart as it was “invented” by William Delbert (W.D.) Gann. “3 period” describes the minimum number of candles needed to form a price “swing” and acts a little like a smoothing mechanism…(shorter period swing charts tend to feature more swings and react more quickly to changes in market trend, but equally are more prone to whipsawing and false signals, whereas longer period swing charts tend to react slower to changes in market trend but produce fewer false signals).

Now how does one draw a Gann 3-period swing chart?

Drawing a “Gann 3 period swing chart”:

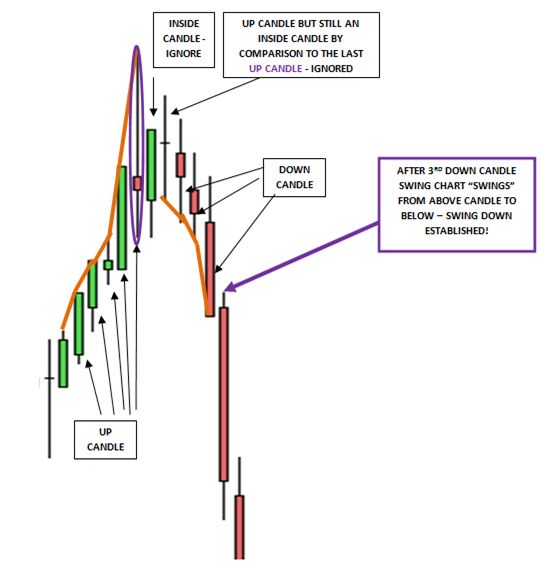

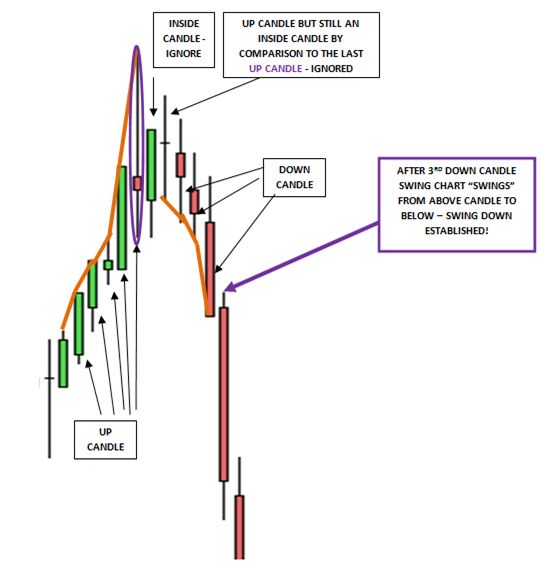

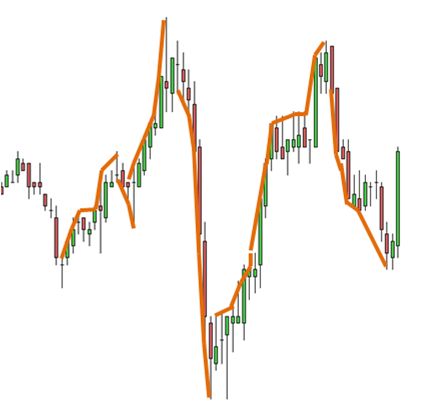

A swing chart is a line superimposed on a bar or candle chart of price action, highlighting the “swing highs” and the “swing lows”. A candle with a higher low and a higher high than the previous candle is known as an “up candle”. As prices rise (due to a series of consecutive up candles) one draws a line connecting the highs of each candle. Inside candles (those days with a higher low and lower high than the previous candle) are ignored.

Down candles are also ignored until (according to W.D. Gann) 3 consecutive down candles occur. At that point the line you have been drawing between candle highs “swings” to the bottom of the 3rd down candle. Again “inside days” are ignored, as are “up” days until 3 occur consecutively.

Although this is normally simplified using a “Manhattan chart” that simply picks out and links the Gann swing highs and Gann swing lows.

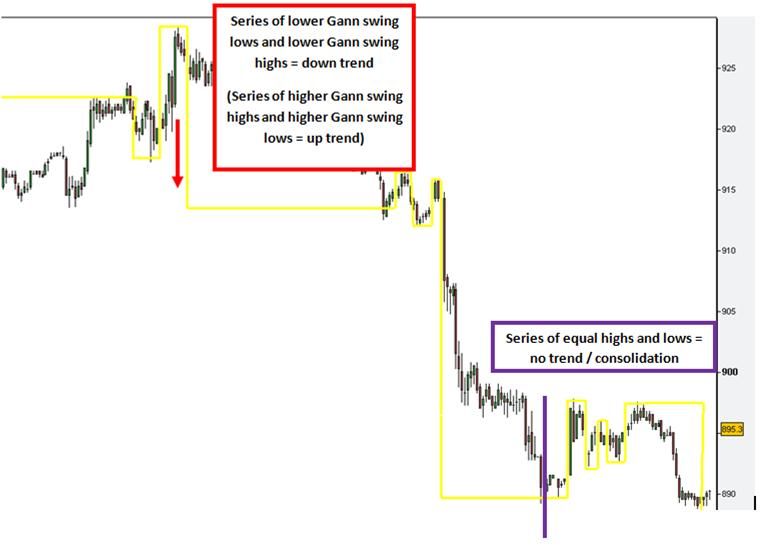

Gann swing trend is then simply calculated using the placement of each consecutive Gann swing high and low – with a series of higher highs and higher lows forming a Gann swing uptrend, and a series of lower highs and lower lows forming a Gann swing downtrend.

That all sounds nice easy doesn’t it?

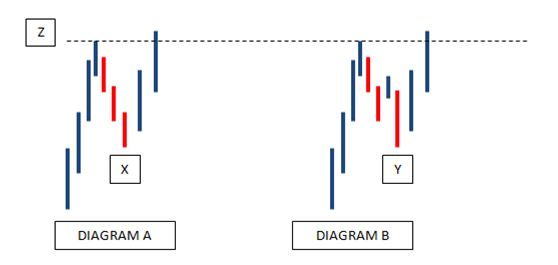

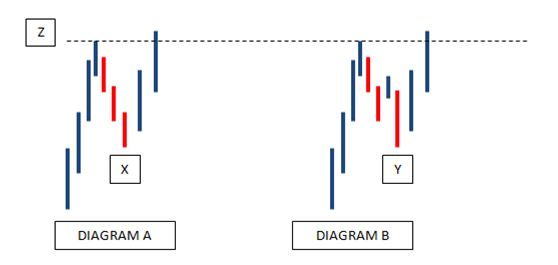

However, in the real world, it is very rare that you will see “3 consecutive” down candles without one, or sometimes even two up candles in between, which would mean normally, even if price moved a significant distance, one wouldn’t be able to class it as a Gann price swing. For example:

Observe diagrams A & B. (Assume trend is up). The “standard” Gann 3 candle pullback is shown in diagram A. A swing low is established at point X. According to W.D. Gann, point Y in diagram B would not qualify as a swing low, because down days are not consecutive. In reality I suggest there is little difference between diagram A and B, so little in fact, one can suggest they are substantially the same. Consequently, I have chosen to modify a traditional Gann 3 period swing chart by relaxing the requirement for there to be 3 “consecutive” days in order for a Gann swing to be formed. I use the definition of 3 lower lows (without there being a new higher high – i.e. higher than “Z” in-between).

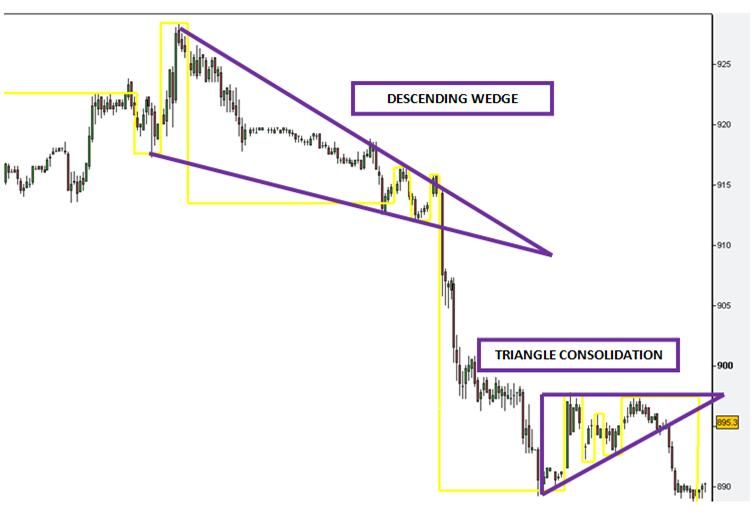

Uses of a Gann 3 period swing chart

Defining support and resistance:

These three uses perform possibly the three most important functions in futures trading. At Swing Trends we use these techniques every day (along with a few other technical analysis techniques) to build a specific trading plan for each day, before the market even opens.

All the best of luck for today’s trading!

Duncan

Duncan

No comments:

Post a Comment